Advanced Metamaterials Design in 2025: Unleashing the Next Wave of Material Innovation. Explore How Breakthroughs in Structure and Functionality Are Shaping the Future of Electronics, Optics, and Beyond.

- Executive Summary: Key Trends and Market Outlook for 2025–2030

- Market Size, Growth Projections, and 18% CAGR Analysis

- Core Technologies: From Electromagnetic to Acoustic Metamaterials

- Leading Players and Innovators: Company Strategies and Partnerships

- Emerging Applications: Telecommunications, Medical Devices, and Energy

- Manufacturing Advances: Scalable Production and Material Integration

- Intellectual Property and Regulatory Landscape

- Challenges: Technical Barriers, Cost, and Commercialization Hurdles

- Case Studies: Real-World Deployments and Pilot Projects

- Future Outlook: Disruptive Potential and Next-Generation Opportunities

- Sources & References

Executive Summary: Key Trends and Market Outlook for 2025–2030

The period from 2025 to 2030 is poised to witness significant advancements in the design and commercialization of advanced metamaterials, driven by breakthroughs in nanofabrication, computational modeling, and integration with emerging technologies such as 6G communications, quantum computing, and next-generation sensing. Metamaterials—engineered composites with properties not found in nature—are increasingly being tailored for specific electromagnetic, acoustic, and mechanical functionalities, opening new frontiers across telecommunications, defense, healthcare, and energy sectors.

A key trend is the acceleration of scalable manufacturing techniques, enabling the transition of metamaterials from laboratory prototypes to industrial-scale applications. Companies such as Meta Materials Inc. are at the forefront, leveraging roll-to-roll production and advanced lithography to produce optical and radio-frequency (RF) metamaterials for applications in transparent antennas, electromagnetic shielding, and smart surfaces. Similarly, Kymeta Corporation is commercializing electronically steerable metamaterial antennas, which are critical for satellite and mobile connectivity, especially as global demand for high-speed, low-latency communications intensifies with the rollout of 5G and the development of 6G networks.

In the defense and aerospace sectors, organizations such as Lockheed Martin and Northrop Grumman are investing in adaptive camouflage, radar-absorbing coatings, and lightweight structural components based on metamaterial architectures. These innovations are expected to enhance stealth capabilities and reduce the weight of aircraft and satellites, contributing to improved performance and fuel efficiency.

Healthcare is another area of rapid metamaterial adoption, with companies like Siemens Healthineers exploring metamaterial-based imaging lenses and sensors to improve the resolution and sensitivity of MRI and other diagnostic modalities. The ability to manipulate electromagnetic waves at subwavelength scales is enabling the development of compact, high-performance medical devices.

Looking ahead, the market outlook for advanced metamaterials is robust, with industry bodies such as the IEEE and Optica (formerly OSA) highlighting the convergence of artificial intelligence, machine learning, and metamaterial design. This convergence is expected to accelerate the discovery of novel material architectures and optimize their performance for specific applications. As regulatory frameworks and standardization efforts mature, the adoption of metamaterials in commercial products is projected to expand rapidly, particularly in telecommunications, automotive, and renewable energy sectors.

In summary, the 2025–2030 period will be characterized by the maturation of advanced metamaterials design, underpinned by industrial-scale manufacturing, cross-sector collaboration, and integration with digital technologies. These trends are set to unlock new market opportunities and drive transformative innovation across multiple industries.

Market Size, Growth Projections, and 18% CAGR Analysis

The advanced metamaterials design sector is poised for robust expansion in 2025 and the following years, driven by escalating demand across telecommunications, defense, medical imaging, and energy harvesting applications. Industry consensus points to a compound annual growth rate (CAGR) of approximately 18% through the late 2020s, reflecting both technological breakthroughs and increasing commercial adoption.

Key players in the metamaterials market, such as Meta Materials Inc., are actively scaling up production capabilities and diversifying their product portfolios. Meta Materials Inc. specializes in functional materials for applications ranging from electromagnetic shielding to advanced optics, and has announced new manufacturing partnerships to meet rising global demand. Similarly, NKT Photonics is advancing the integration of metamaterials into photonic devices, targeting sectors like quantum computing and high-speed communications.

The telecommunications industry, in particular, is a major growth driver, as 5G and emerging 6G networks require advanced antenna and wave-manipulation solutions. Companies such as Nokia are exploring metamaterial-based antennas to enhance signal strength and reduce interference, aiming for commercial deployment within the next few years. In defense, organizations like Lockheed Martin are investing in stealth and radar-absorbing metamaterial coatings, with several pilot projects expected to transition to full-scale production by 2026.

Medical imaging and diagnostics represent another high-growth segment. Siemens Healthineers is investigating metamaterial-enhanced MRI and CT systems to improve image resolution and reduce scan times, with early-stage clinical trials underway. The energy sector is also witnessing innovation, as companies like First Solar explore metamaterial coatings to boost photovoltaic efficiency and durability.

Geographically, North America and Europe are leading in R&D investment and early commercialization, but Asia-Pacific is rapidly catching up, with significant government and private sector funding. The next few years are expected to see increased collaboration between material suppliers, device manufacturers, and end-users, accelerating the path from laboratory innovation to market-ready solutions.

Overall, the advanced metamaterials design market is on a trajectory of sustained double-digit growth, with an 18% CAGR underpinned by cross-sectoral demand, expanding manufacturing capacity, and a steady pipeline of new applications. As more industries recognize the transformative potential of metamaterials, the sector is set to become a cornerstone of next-generation technology platforms.

Core Technologies: From Electromagnetic to Acoustic Metamaterials

Advanced metamaterials design is rapidly evolving, driven by breakthroughs in computational modeling, fabrication techniques, and interdisciplinary collaboration. In 2025, the field is characterized by a shift from theoretical exploration to practical, scalable solutions across electromagnetic and acoustic domains. The integration of artificial intelligence (AI) and machine learning (ML) into the design process is enabling the discovery of novel metamaterial architectures with tailored properties, such as negative refractive index, cloaking, and tunable absorption.

Electromagnetic metamaterials remain at the forefront, with companies like Meta Materials Inc. and NKT Photonics advancing the commercialization of components for applications in telecommunications, sensing, and imaging. Meta Materials Inc. is notable for its development of transparent conductive films and advanced optical filters, leveraging proprietary nano-patterning techniques to achieve precise control over electromagnetic wave propagation. These innovations are being integrated into next-generation displays, LiDAR systems, and wireless communication devices.

In the acoustic metamaterials sector, research is translating into deployable products for noise reduction, vibration control, and sound manipulation. Companies such as Eaton are exploring the use of engineered structures to create lightweight, high-performance acoustic barriers for automotive and industrial applications. The ability to design materials that can selectively block, absorb, or redirect sound waves is opening new possibilities in urban infrastructure and consumer electronics.

A key trend in 2025 is the convergence of electromagnetic and acoustic metamaterials, with hybrid designs enabling multifunctional devices. For example, tunable metasurfaces—engineered at the subwavelength scale—are being developed to dynamically control both light and sound, paving the way for adaptive sensors and smart environments. The adoption of advanced manufacturing methods, such as nanoimprint lithography and additive manufacturing, is crucial for scaling production while maintaining the intricate geometries required for metamaterial functionality.

Looking ahead, the outlook for advanced metamaterials design is robust. Industry leaders are investing in collaborative research with academic institutions and government agencies to accelerate the transition from laboratory prototypes to market-ready solutions. The next few years are expected to see increased deployment of metamaterial-enabled devices in 5G/6G communications, medical imaging, and energy harvesting. As the ecosystem matures, standardization efforts and supply chain development will further support the integration of metamaterials into mainstream technologies, solidifying their role as a cornerstone of future innovation.

Leading Players and Innovators: Company Strategies and Partnerships

The advanced metamaterials sector in 2025 is characterized by a dynamic landscape of leading players, innovative startups, and strategic partnerships driving the commercialization of next-generation materials. Companies are leveraging breakthroughs in nanofabrication, computational design, and scalable manufacturing to address applications in telecommunications, defense, energy, and healthcare.

One of the most prominent companies in this space is Meta Materials Inc., which has established itself as a leader in the design and production of functional metamaterials for electromagnetic applications. The company’s portfolio includes transparent conductive films, advanced antenna systems, and specialty coatings, with a focus on scalable roll-to-roll manufacturing. In 2024 and 2025, Meta Materials Inc. has expanded its strategic partnerships with global electronics manufacturers and aerospace firms to accelerate the integration of metamaterials into commercial products.

Another key innovator is NKT Photonics, specializing in photonic crystal fibers and advanced optical components. Their expertise in manipulating light at the nanoscale has led to collaborations with research institutions and industrial partners to develop next-generation sensors and communication devices. NKT Photonics’ ongoing projects in 2025 include joint ventures with European defense contractors to enhance stealth and detection capabilities using engineered optical metamaterials.

In the United States, Northrop Grumman continues to invest heavily in metamaterials research, particularly for defense and aerospace applications. The company’s R&D efforts focus on radar-absorbing materials, adaptive camouflage, and lightweight structural components. Northrop Grumman’s partnerships with national laboratories and universities are aimed at accelerating the transition of laboratory-scale innovations to field-ready solutions.

Startups are also playing a pivotal role. Kymeta Corporation is notable for its development of metamaterial-based flat-panel antennas, which are being adopted for satellite communications in mobility and defense sectors. Kymeta’s strategic alliances with satellite operators and automotive manufacturers are expected to drive significant market growth through 2025 and beyond.

On the materials supply side, 3M is leveraging its expertise in advanced films and coatings to support the scalable production of metamaterial components. The company’s collaborations with electronics and energy sector leaders are focused on integrating metamaterials into next-generation displays, batteries, and energy harvesting devices.

Looking ahead, the sector is expected to see increased cross-industry partnerships, with companies like Meta Materials Inc., Northrop Grumman, and 3M at the forefront of efforts to standardize processes and accelerate commercialization. The convergence of advanced simulation tools, additive manufacturing, and global supply chain integration will likely define the competitive landscape for advanced metamaterials design through the remainder of the decade.

Emerging Applications: Telecommunications, Medical Devices, and Energy

Advanced metamaterials design is rapidly transforming key sectors such as telecommunications, medical devices, and energy, with 2025 marking a pivotal year for commercial deployment and research breakthroughs. Metamaterials—engineered composites with properties not found in nature—are enabling unprecedented control over electromagnetic waves, sound, and heat, opening new frontiers for device performance and miniaturization.

In telecommunications, the demand for higher data rates and more efficient spectrum use is driving the adoption of metamaterial-based antennas and components. Companies like Kyocera Corporation and Nokia are actively developing and integrating metamaterial antennas into 5G and emerging 6G infrastructure. These antennas offer ultra-thin profiles, beam steering, and frequency agility, which are critical for dense urban deployments and the Internet of Things (IoT). In 2025, pilot deployments of reconfigurable intelligent surfaces (RIS) are expected to enhance signal propagation and reduce energy consumption in next-generation wireless networks.

The medical device sector is also witnessing significant advances. Metamaterial-based sensors and imaging devices are being designed for higher sensitivity and specificity. Medtronic and Siemens Healthineers are exploring metamaterial coatings and structures to improve MRI resolution and reduce device interference. Additionally, wearable health monitors utilizing metamaterial sensors are entering clinical trials, promising non-invasive, real-time diagnostics with improved accuracy. The next few years are expected to see regulatory approvals and initial commercialization of these devices, particularly in cardiovascular and neurological monitoring.

In the energy sector, advanced metamaterials are being leveraged to boost the efficiency of solar panels and thermal management systems. First Solar is investigating metamaterial coatings to minimize reflection and maximize light absorption, while Siemens Energy is researching thermal metamaterials for improved heat exchangers and insulation in power plants. These innovations are projected to contribute to lower energy costs and enhanced sustainability, with pilot projects and field tests underway in 2025.

Looking ahead, the convergence of advanced metamaterials design with artificial intelligence and additive manufacturing is expected to accelerate the pace of innovation. As fabrication techniques mature and costs decrease, broader adoption across telecommunications, healthcare, and energy is anticipated. Industry collaborations and standardization efforts will be crucial to ensure interoperability and safety, setting the stage for metamaterials to become foundational in next-generation technologies.

Manufacturing Advances: Scalable Production and Material Integration

The field of advanced metamaterials design is experiencing significant progress in manufacturing techniques, with a strong focus on scalable production and seamless material integration. As of 2025, the transition from laboratory-scale fabrication to industrial-scale manufacturing is a central challenge and opportunity, driven by the growing demand for metamaterials in telecommunications, aerospace, defense, and medical devices.

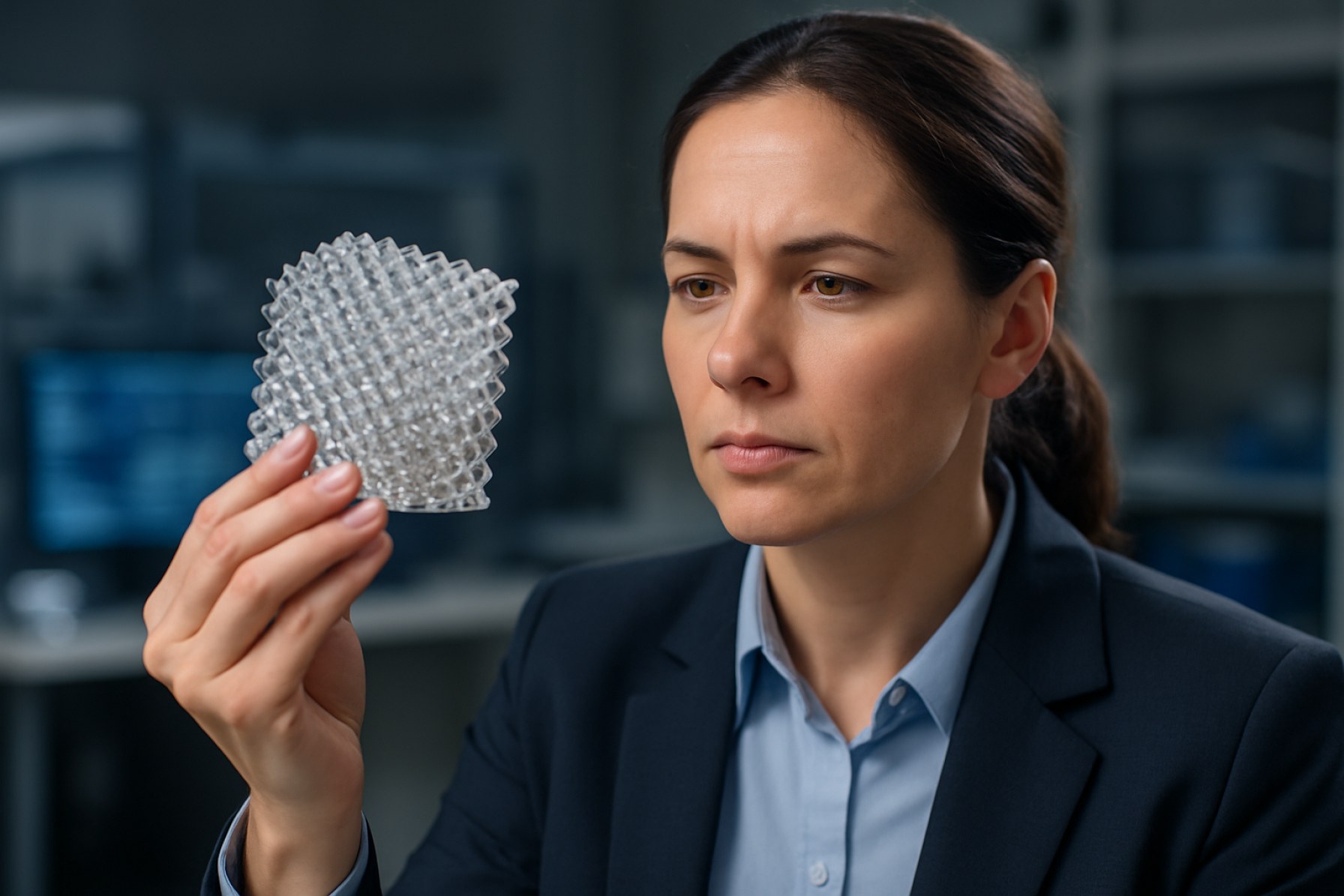

One of the most notable advances is the adoption of additive manufacturing (AM) and nanoimprint lithography (NIL) for producing complex metamaterial structures with high precision and repeatability. Companies such as Nanoscribe GmbH & Co. KG are at the forefront, offering two-photon polymerization 3D printers capable of fabricating intricate micro- and nano-architectures essential for optical and electromagnetic metamaterials. Their systems are being integrated into pilot production lines, enabling batch fabrication of components for photonic and sensing applications.

In parallel, roll-to-roll (R2R) processing is emerging as a scalable solution for flexible and large-area metamaterials, particularly in the terahertz and microwave regimes. FlexEnable Limited and similar companies are leveraging R2R techniques to deposit functional layers on flexible substrates, paving the way for cost-effective production of conformal antennas and electromagnetic shielding films. These advances are crucial for integrating metamaterials into consumer electronics and automotive systems, where large volumes and mechanical flexibility are required.

Material integration remains a key focus, as the performance of metamaterials often depends on the compatibility of constituent materials and their interfaces. Efforts are underway to develop hybrid metamaterials that combine metals, dielectrics, and emerging 2D materials such as graphene. Oxford Instruments plc is actively developing deposition and etching tools tailored for precise layering and patterning of such materials, supporting the fabrication of multi-functional metamaterial devices.

Looking ahead, the next few years are expected to see further automation and digitalization of metamaterial manufacturing, with machine learning algorithms optimizing process parameters for yield and performance. Industry collaborations and standardization efforts, led by organizations like IEEE, are anticipated to accelerate the adoption of scalable manufacturing protocols and quality assurance benchmarks. As these advances mature, the integration of metamaterials into mainstream products is likely to expand, unlocking new functionalities in wireless communication, imaging, and energy harvesting systems.

Intellectual Property and Regulatory Landscape

The intellectual property (IP) and regulatory landscape for advanced metamaterials design is rapidly evolving as the field matures and commercial applications proliferate. In 2025, the number of patent filings related to metamaterials—particularly in areas such as electromagnetic cloaking, tunable optics, and next-generation antennas—continues to rise, reflecting both increased R&D activity and the strategic importance of proprietary technologies. Major industry players, including Meta Materials Inc. and Nokia, have expanded their patent portfolios, focusing on innovations in radio-frequency (RF) metamaterials, transparent conductive films, and energy harvesting surfaces. Meta Materials Inc., for example, holds a broad array of patents covering functional metamaterial films and devices for applications in automotive, aerospace, and consumer electronics.

The regulatory environment is also adapting to the unique challenges posed by metamaterials. In the United States, the United States Patent and Trademark Office (USPTO) has seen a marked increase in filings that require examiners to assess the novelty and non-obviousness of complex, multi-scale material architectures. Similarly, the European Patent Office (EPO) is updating its guidelines to address the interdisciplinary nature of metamaterials, which often span physics, materials science, and electrical engineering. Regulatory agencies are also beginning to consider the safety and environmental impact of large-scale deployment, particularly for metamaterials used in telecommunications and energy sectors.

Internationally, harmonization of standards is a growing focus. Organizations such as the International Electrotechnical Commission (IEC) and the International Organization for Standardization (ISO) are initiating working groups to develop guidelines for the characterization, testing, and certification of metamaterial-based products. These efforts aim to facilitate global trade and ensure interoperability, especially as companies like Nokia and Meta Materials Inc. expand their international operations.

Looking ahead, the next few years are expected to bring increased scrutiny of IP claims as more entities enter the market and as metamaterials become integral to critical infrastructure, such as 6G communications and advanced sensing systems. Regulatory bodies are likely to introduce new frameworks for risk assessment and lifecycle management, particularly as metamaterials are integrated into consumer-facing and safety-critical applications. The interplay between robust IP protection and adaptive regulatory oversight will be crucial in shaping the pace and direction of innovation in advanced metamaterials design through 2025 and beyond.

Challenges: Technical Barriers, Cost, and Commercialization Hurdles

The commercialization of advanced metamaterials design faces several persistent challenges, particularly in the areas of technical barriers, cost, and market adoption. As of 2025, while laboratory demonstrations of novel metamaterial functionalities—such as negative refractive index, tunable electromagnetic response, and cloaking—have proliferated, scaling these innovations for industrial use remains a significant hurdle.

One of the primary technical barriers is the complexity of fabricating metamaterials with precise nanoscale architectures. Many of the most promising designs require intricate three-dimensional structuring at sub-wavelength scales, which is difficult to achieve with conventional manufacturing techniques. Although advances in nanoimprint lithography, electron-beam lithography, and additive manufacturing have improved patterning capabilities, these methods are often slow and expensive when applied to large-area production. Companies such as NKT Photonics and Nanoscribe are at the forefront of developing high-resolution fabrication tools, but throughput and cost remain limiting factors for widespread adoption.

Material losses, especially at optical frequencies, present another technical challenge. Many metamaterials rely on metallic components, which can introduce significant absorption losses, reducing device efficiency. Research into alternative materials, such as high-index dielectrics and two-dimensional materials, is ongoing, but integrating these into scalable manufacturing processes is still under development. Organizations like Oxford Instruments are working on advanced deposition and etching systems to address these integration issues.

Cost is a major barrier to commercialization. The high price of raw materials, coupled with the expense of precision fabrication, results in metamaterial components that are often orders of magnitude more expensive than conventional alternatives. This cost premium limits their use to niche applications, such as specialized optics, defense, and research instrumentation. For example, Metamaterial Inc. is targeting high-value sectors like aerospace and medical imaging, where performance gains can justify higher costs, but broader adoption in consumer electronics or telecommunications remains constrained.

Finally, the lack of standardized testing protocols and reliability data impedes market confidence. End-users require assurances of long-term stability, reproducibility, and compatibility with existing systems. Industry consortia and standards bodies, including IEEE, are beginning to address these gaps, but comprehensive frameworks are still in development.

Looking ahead, overcoming these challenges will require coordinated advances in materials science, scalable manufacturing, and industry standards. As fabrication technologies mature and costs decrease, the next few years may see metamaterials transition from laboratory curiosities to enabling components in mainstream applications, provided that technical and commercial barriers can be systematically addressed.

Case Studies: Real-World Deployments and Pilot Projects

The deployment of advanced metamaterials has accelerated in recent years, with several high-profile case studies and pilot projects demonstrating their transformative potential across industries. In 2025, the focus is on real-world applications that move beyond laboratory prototypes, particularly in telecommunications, aerospace, and automotive sectors.

One of the most notable deployments is in the telecommunications industry, where Nokia has partnered with leading research institutions to integrate metamaterial-based antennas into 5G and emerging 6G infrastructure. These antennas, leveraging engineered surfaces for beam steering and signal enhancement, have been piloted in urban environments to address signal attenuation and improve network reliability. Early data from these pilots indicate up to a 30% increase in signal strength and a significant reduction in interference, paving the way for commercial rollouts in dense cityscapes.

In aerospace, Airbus has advanced the use of metamaterial coatings for electromagnetic shielding and radar cross-section reduction. In 2024 and 2025, Airbus conducted flight tests with aircraft components featuring these coatings, demonstrating improved stealth characteristics and reduced electromagnetic interference with onboard systems. The company is now collaborating with suppliers to scale up production for integration into next-generation commercial and defense aircraft.

The automotive sector has also seen significant pilot projects. Continental AG, a major automotive supplier, has developed metamaterial-based sensors for advanced driver-assistance systems (ADAS). In 2025, Continental is running field trials with several OEM partners, testing sensors that offer enhanced object detection and resilience to environmental noise. These pilots are expected to inform the design of safer, more reliable autonomous vehicles.

Another noteworthy case is the collaboration between Merck KGaA and display manufacturers to commercialize tunable metamaterial films for augmented reality (AR) headsets. These films, piloted in 2024 and expanded in 2025, enable dynamic control of light transmission and color filtering, resulting in improved visual clarity and energy efficiency for wearable devices.

Looking ahead, these case studies underscore a trend toward industry-driven innovation, with pilot projects rapidly transitioning to commercial-scale deployments. As manufacturing techniques mature and costs decrease, the next few years are expected to see broader adoption of advanced metamaterials, particularly in sectors where performance gains can be directly quantified and monetized.

Future Outlook: Disruptive Potential and Next-Generation Opportunities

The future outlook for advanced metamaterials design in 2025 and the coming years is marked by rapid technological evolution, with disruptive potential across multiple industries. Metamaterials—engineered composites with properties not found in nature—are poised to revolutionize sectors such as telecommunications, defense, healthcare, and energy. The convergence of computational design, additive manufacturing, and nanofabrication is enabling the creation of increasingly complex and functional metamaterial structures.

In telecommunications, the demand for higher data rates and more efficient spectrum utilization is driving the adoption of metamaterial-based antennas and components. Companies like Kymeta Corporation are advancing flat-panel satellite antennas using metamaterial technology, offering electronically steerable beams for mobile connectivity. These innovations are expected to play a critical role in the rollout of 5G and the development of 6G networks, where beamforming and miniaturization are essential.

Defense and security applications are also at the forefront, with organizations such as Lockheed Martin investing in metamaterial-based cloaking and stealth technologies. These materials can manipulate electromagnetic waves to reduce radar signatures or create adaptive camouflage, offering significant tactical advantages. The U.S. Department of Defense continues to fund research into tunable and reconfigurable metamaterials for next-generation sensors and communication systems.

In healthcare, metamaterials are enabling breakthroughs in imaging and diagnostics. For example, Meta Materials Inc. is developing advanced optical components for medical imaging, including lenses with super-resolution capabilities and non-invasive biosensors. These innovations could lead to earlier disease detection and improved patient outcomes.

Energy harvesting and wireless power transfer are emerging opportunities, with metamaterials being engineered to enhance the efficiency of photovoltaic cells and wireless charging systems. Companies such as Meta Materials Inc. are also exploring applications in transparent conductive films and smart windows, which could contribute to energy savings in buildings and vehicles.

Looking ahead, the integration of artificial intelligence and machine learning into metamaterials design workflows is expected to accelerate the discovery of novel structures with tailored electromagnetic, acoustic, or mechanical properties. The next few years will likely see the commercialization of programmable and multifunctional metamaterials, opening new markets and enabling disruptive products. As manufacturing techniques mature and costs decrease, the adoption of advanced metamaterials is set to expand, driving innovation across industries and reshaping the technological landscape.

Sources & References

- Meta Materials Inc.

- Lockheed Martin

- Northrop Grumman

- Siemens Healthineers

- IEEE

- NKT Photonics

- Nokia

- First Solar

- Eaton

- Medtronic

- Siemens Energy

- Nanoscribe GmbH & Co. KG

- FlexEnable Limited

- Oxford Instruments plc

- European Patent Office

- International Organization for Standardization

- Oxford Instruments

- Airbus